Enterprise Content Management Market by Offering (Solutions (Document Management, Record Management), Services), Business Function (Sales & Marketing, Human Resources), Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2029

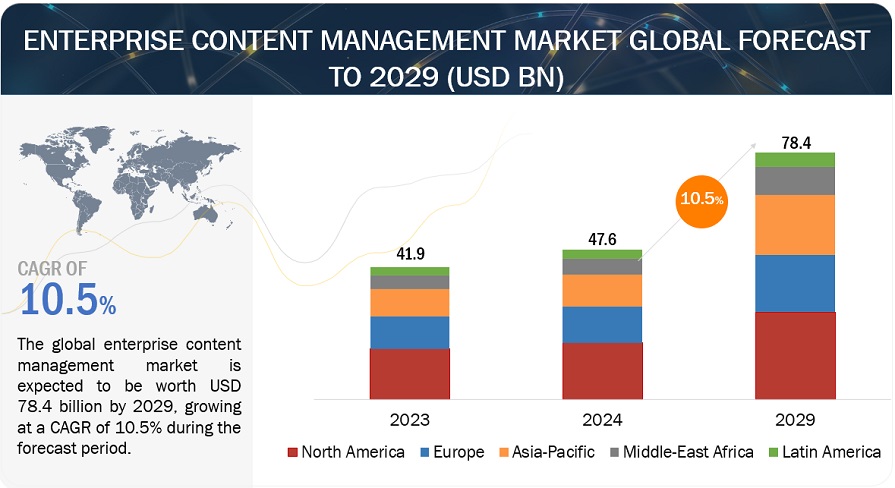

[354 Pages Report] The global enterprise content management market will grow from USD 47.6 billion in 2024 to USD 78.4 billion by 2029 at a compounded annual growth rate (CAGR) of 10.5% during the forecast period.

The growth of enterprise content management (ECM) is significantly enhanced by the integration of advanced technologies such as business process management (BPM), 5G, automation, natural language processing (NLP), and cloud computing. BPM complements ECM by streamlining and automating complex workflows, ensuring that content management processes are efficient and aligned with business goals. This integration allows for better resource allocation, faster decision-making, and improved compliance management. The advent of 5G technology further amplifies ECM capabilities by providing high-speed connectivity, enabling real-time data processing, and facilitating seamless access to content from any location. This is particularly beneficial for industries that require instantaneous data access and collaboration, such as healthcare, finance, and manufacturing.

Moreover, automation and NLP are transforming ECM by automating routine tasks and enhancing data extraction and analysis. Automation tools reduce manual effort in document handling, indexing, and retrieval, thereby increasing operational efficiency and reducing errors. NLP enables ECM systems to understand and process human language, improving the accuracy of information categorization and search capabilities. This technology is instrumental in managing large volumes of unstructured data, such as emails and social media content. Lastly, cloud computing is another critical driver of ECM growth, offering scalable storage solutions and ensuring that content is accessible, secure, and backed up. Cloud-based ECM solutions support remote work and global collaboration by allowing users to access and share documents from anywhere. Together, these technologies are propelling the evolution of ECM, making it a more powerful tool for enhancing productivity, ensuring compliance, and driving innovation across various sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Enterprise Content Management Market Dynamics

Driver: Increased need for compliance and audit management to enhance corporate governance

The enterprise content management market is witnessing a significant surge in the demand for compliance and audit management solutions, driven by the increased emphasis on corporate governance. Companies face mounting pressure to adhere to regulatory standards and demonstrate transparency in their operations. As a result, there is a growing need for ECM solutions that offer robust compliance features, enabling organizations to manage and track regulatory requirements effectively. In today's business landscape, regulatory compliance is no longer just a box to check—it's a critical component of corporate governance. Non-compliance can lead to severe penalties, reputational damage, and legal consequences. Therefore, businesses invest in ECM systems that provide comprehensive audit trails, document management capabilities, and automated compliance workflows.

Moreover, enhanced compliance and audit management ensure adherence to regulatory mandates and contribute to improved information governance. By centralizing document storage, enforcing access controls, and facilitating secure collaboration, ECM solutions empower organizations to maintain data integrity and mitigate risks associated with non-compliance. Overall, the increased need for compliance and audit management solutions drives the growth of the enterprise content management market as businesses prioritize robust governance frameworks to navigate an increasingly complex regulatory environment.

Restraint: Misunderstandings regarding data security and privacy risks

Misunderstandings surrounding data security and privacy risks significantly restrain the enterprise content management market. These misconceptions often stem from a lack of awareness or misinformation about the potential threats associated with storing and managing sensitive data. Organizations may need to pay more attention to the likelihood and severity of data breaches, leading them to allocate insufficient resources toward implementing robust ECM solutions.

Another aspect of this restraint is the tendency to overlook the regulatory implications of data security and privacy. Many businesses may need to fully grasp the legal requirements and compliance standards governing the protection of sensitive information. As a result, they may fail to prioritize adequate measures for ensuring compliance with relevant regulations, putting them at risk of penalties and reputational damage in the event of a breach. In summary, misunderstandings regarding data security and privacy risks hinder the implementation of effective ECM solutions. Addressing these misconceptions requires heightened awareness, education, and a proactive approach to data governance to mitigate the associated risks effectively.

Opportunity: Increasing adoption of big data analytics revolutionizing next-gen ECM for improved decision-making

The increasing adoption of big data analytics presents a significant opportunity for the enterprise content management market as organizations seek to leverage data-driven insights for enhanced decision-making. By harnessing advanced analytics techniques, businesses can extract valuable intelligence from vast unstructured content, including documents, emails, and multimedia files. This wealth of information enables them to gain deeper insights into customer behavior, market trends, and operational efficiencies, empowering more informed and strategic decision-making processes.

Moreover, integrating big data analytics with ECM systems enables the development of next-generation solutions that offer enhanced capabilities for managing, analyzing, and extracting actionable insights from diverse data sources. These advanced ECM platforms leverage ML algorithms and NLP techniques to automate content classification, sentiment analysis, and predictive analytics, thereby streamlining decision-making processes across the organization. By harnessing the power of big data analytics, businesses can unlock new opportunities for innovation, competitiveness, and growth in the ever-evolving digital landscape.

Challenge: Lack of skilled workforce and poor management in creating user adoption processes

The enterprise content management market faces challenges from a lack of skilled workforce and inadequate management practices in driving user adoption processes. With the rapid evolution of ECM technologies, there is a growing demand for professionals proficient in ECM implementation, administration, and customization. However, many organizations need help finding individuals with the necessary skills and expertise to deploy and manage ECM solutions effectively. This shortage of skilled workers hampers the successful implementation and utilization of ECM systems, leading to delays, inefficiencies, and underutilization of valuable resources.

Furthermore, poor management practices in creating user adoption processes pose a significant challenge for ECM initiatives. Achieving widespread user acceptance and engagement is essential for the success of ECM projects, yet many organizations need to implement effective strategies for driving user adoption. Inadequate training, communication, and change management efforts can result in resistance to new ECM technologies and workflows, hindering their integration into daily business operations. Overcoming these challenges requires organizations to prioritize investment in training and development programs, establish clear communication channels, and change management protocols to foster a culture of user adoption and collaboration around ECM initiatives.

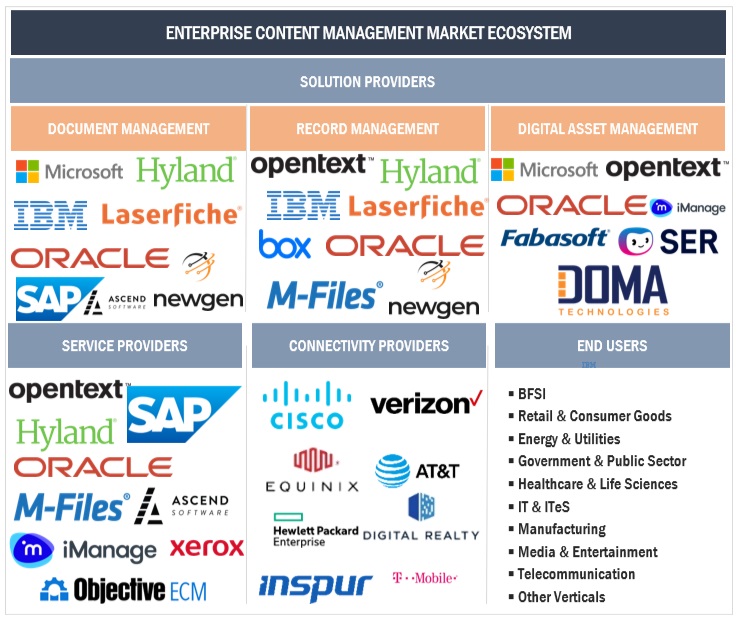

Enterprise Content Management Market Ecosystem

Based on the vertical, the retail & consumer goods vertical is expected to dominate the market during the forecast period.

Based on the vertical, the enterprise content management market is segmented into BFSI, retail & consumer goods, IT & ITeS, telecommunications, healthcare & life sciences, manufacturing, energy & utilities, media & entertainment, government & public sector, and other verticals. Retail & consumer goods are expected to hold the largest market share during the forecast period. ECM is pivotal in managing vast digital content, including product information, marketing collateral, and customer data in the retail and consumer goods vertical. ECM streamlines content creation, approval processes, and distribution workflows, ensuring consistent and accurate product information across multiple channels, such as websites, mobile apps, and physical stores. It enhances collaboration among merchandising, marketing, and sales teams, facilitating quicker decision-making and time-to-market for new products. Additionally, ECM supports regulatory compliance by managing documentation related to product safety standards, supply chain transparency, and consumer data privacy regulations such as GDPR. Overall, ECM in retail and consumer goods optimizes operational efficiency, enhances customer experiences, and enables organizations to stay competitive in the fast-paced market.

Based on the organization's size, the SME segment is expected to have the highest CAGR growth rate during the forecast period.

The enterprise content management market by organization size is segmented into large enterprises and SMEs. As per the organization size, the SME segment is expected to hold the highest CAGR during the forecast period. ECM managers are the ones who make SMEs use their digital content and information more efficiently by helping them manage and turn it into their advantage. ECM solutions make SMEs' digital assets management, such as documents, data, and other digital assets, more organized, stored, and retrieved to share as needed. By establishing ECM systems, SMEs can automate their core business functions, facilitate effective collaboration among members, and increase organizational productivity accordingly. Through document management, workflow automation, version control, and document security, ECM solutions for SMEs give businesses the means to deal with the organization's content during its lifecycle.

Furthermore, the ECM services often integrate functions such as implementation, customization, training, and ongoing help, which help SMEs fully exploit their ECM systems' capabilities. The businesses SMEs, in particular, can benefit from significant savings in lowering operations costs, maximizing efficiency, reducing manual tasks, reducing error risk, and compliance with industry rules and regulations with ECM solutions and services. Via ECM, SMEs can grow into productive, scalable, and thriving organizations in the digital business ecosystem.

Based on the business function, human resources will dominate the market during the forecast period.

The enterprise content management market is segmented into human resources, sales & marketing, accounting & legal, procurement & supply chain management, and other business functions based on the business function. Human resources are expected to hold the largest market share during the forecast period. At the level of HR business operations, ECM plays a significant role in HR processes organization, productivity enhancement, and compliance with regulatory bodies' requirements. ECM solutions allow HR departments to measure the lifecycle of documents while helping them manage all employee-related documents, such as resumes, applications, contracts, employee performance evaluations, and training material. Through ECM systems, reliable repositories for all HR-related documentation are provided. This simplifies document management processes by putting the necessary documents right at the fingertips of the HR professional so that they can effortlessly search, access, and retrieve employee-related information quickly and accurately. Besides that, ECM solutions automate workflow management processes, which are tasks such as employee onboarding, performance assessment, and training. This leads to less manual tasks. In addition, ECM solutions simplify the functions of the HR departments for security and meeting regulatory requirements by helping in the secure storage and management of sensitive employee data, enforcing retention policies, and providing audit trails for tracking document access and changes. Overall, ECM solutions are a great asset to the HR departments. Their productivity improvements, cost-cutting, and risk mitigation help HR focus on strategic HR initiatives and benefit the organization.

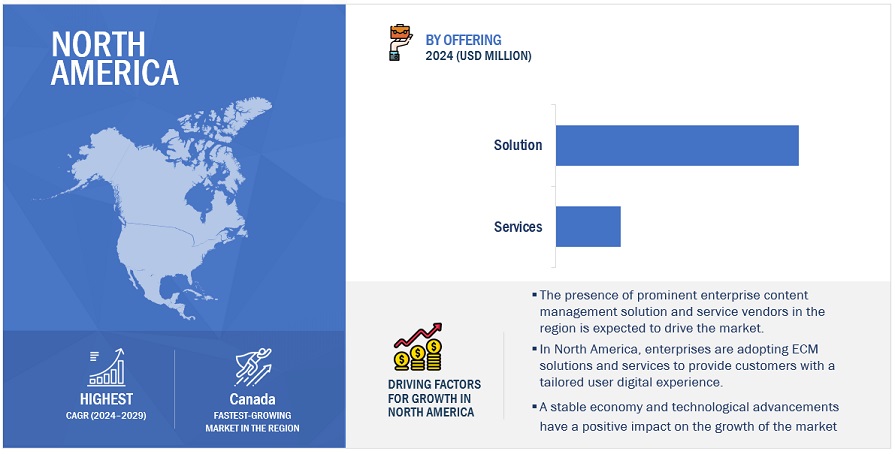

The US market contributes the largest share of North America's enterprise content management market.

North America is expected to lead the enterprise content management market in 2024. The US is estimated to account for the largest market share in North America in 2024, the enterprise content management market, and the trend is expected to continue until 2029. ECM solutions and services play a crucial role in the US region, helping organizations efficiently manage, store, and secure their digital content. These solutions streamline document management, record management, digital asset management, and workflow automation processes, ensuring regulatory compliance and improving collaboration and productivity. With the increasing volume of digital content generated by businesses, the demand for ECM solutions has been steadily growing, particularly in healthcare, finance, government, and manufacturing industries.

Key companies operating in the US enterprise content management market include IBM Corporation, OpenText Corporation, Microsoft Corporation, Oracle Corporation, and Hyland Software. These companies offer a wide range of ECM solutions and services, catering to the diverse needs of organizations across different industries. With the growing importance of efficient content management and the increasing digitization of businesses, the ECM market in the US is expected to continue its growth trajectory in the coming years.

Key market players

The enterprise content management market is dominated by a few globally established players such as Microsoft (US), OpenText (US), Box (US), Hyland (US), IBM (US), Adobe (US), Xerox (US), Atlassian (Australia), KYOCERA (JAPAN), and Oracle (US) among others, are the key vendors that secured enterprise content management contracts in last few years. Local participants only have local experience, while these vendors can add global processes and execution expertise. Customers are likelier to try new things in the enterprise content management market because of their higher discretionary budgets, ease of access to information, and quick adoption of technical items.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Organization Size, Business Function, Deployment Mode, and Vertical |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East Africa, and Latin America |

|

Companies Covered |

Some of the significant enterprise content management market vendors are Microsoft (US), OpenText (Canada), Box (US), Hyland (US), IBM (US), Adobe (US), Xerox (US), Atlassian (Australia), KYOCERA Corporation (Japan), and Oracle (US). |

This research report categorizes the enterprise content management market based on offering, organization size, business function, deployment mode, vertical, and region.

Based on the Offering:

-

Solution

- Document Management

- Case Management

- Record Management

- Imaging & Capturing

- Web & Mobile Content Management

- Digital Asset Management

- Collaborative Content Management

- eDiscovery

- Other Solutions

-

Services

-

Professional Services

- Deployment & Integration

- Training & Consulting

- Support & Maintenance

-

Managed Services

- Content Analytics & Reporting

- Managed Print & Output Services

- Content Migration Services

-

Professional Services

Based on the Business Function:

- Human Resources

- Sales & Marketing

- Accounting & Legal

- Procurement & Supply Chain Management

- Other Business Functions

Based on the Deployment Mode:

- Cloud

- On-premises

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the Vertical:

- BFSI

- Retail & Consumer Goods

- IT & ITeS

- Telecommunications

- Healthcare & Life Sciences

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Government & Public Sector

- Other Verticals

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

Gulf Cooperation Councils (GCC)

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of GCC Countries

- South Africa

- Rest of the Middle East Africa

-

Gulf Cooperation Councils (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2024, Hyland, a leading global provider of intelligent content solutions, launched Hyland Experience Automate (Hx Automate). This service is one of the first available from the next-generation, cloud-based platform, Hyland Experience (Hx). This new service is compatible with existing Hyland platforms, allowing customers to leverage the latest innovation from Hyland Experience while maximizing the value of their current solutions.

- In April 2024, Box announced its collaboration with Bulletproof, an award-winning independent global brand agency, which selected Box as its single centralized cloud platform to manage content and production work. Bulletproof is deploying Box across the organization to eliminate on-premise servers and facilitate secure collaboration with clients and partners.

- In February 2024, Microsoft announced its collaboration with SysKit, a company dedicated to simplifying management and governance in Microsoft 365, and announced the availability of Syskit Point on Microsoft AppSource. This integration underscores SysKit Point's commitment to providing seamless experiences for Office 365 users, empowering them with robust tools to optimize their governance, security, and compliance efforts within the Microsoft environment.

- In January 2024, Oracle's content management enabled users to export and import repository content. The Export Jobs and Import Jobs pages would allow users to track new jobs.

- In January 2024, Datamax extended its strategic partnership with KYOCERA. This partnership further bolsters Datamax's ability to adhere to its tagline, "Relevant Technology. Raving Results."

Frequently Asked Questions (FAQ):

What is enterprise content management?

Enterprise Content Management (ECM) is a comprehensive approach to managing the digital content lifecycle within an organization, encompassing creation, capture, storage, retrieval, and distribution. It uses specialized software and strategies to organize, secure, and leverage content assets, including documents, images, videos, and other digital files. ECM aims to improve business processes by providing centralized access to information, facilitating user collaboration, and ensuring compliance with regulatory requirements. It enables organizations to streamline workflows, reduce operational costs, mitigate risks, and enhance decision-making by effectively managing and utilizing their content resources.

Which country was the early adopter of enterprise content management?

The US was at the initial stage of adopting enterprise content management.

Which are the key vendors exploring enterprise content management?

Some of the significant vendors offering enterprise content management worldwide include Microsoft (US), OpenText (Canada), Box (US), Hyland (US), IBM (US), Adobe (US), Xerox (US), Atlassian (Australia), KYOCERA Corporation (Japan), and Oracle (US).

What is the total CAGR recorded for the enterprise content management market from 2024 to 2029?

The enterprise content management market will record a CAGR of 10.5% from 2024 to 2029.

Who are vital clients adopting the enterprise content management market?

- Training and consulting service providers

- Information Technology (IT) infrastructure providers

- ECM solutions providers

- ECM service providers

- Government organizations and standardization bodies

- Regional associations

- ECM vendors

- Value-added resellers and distributors

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

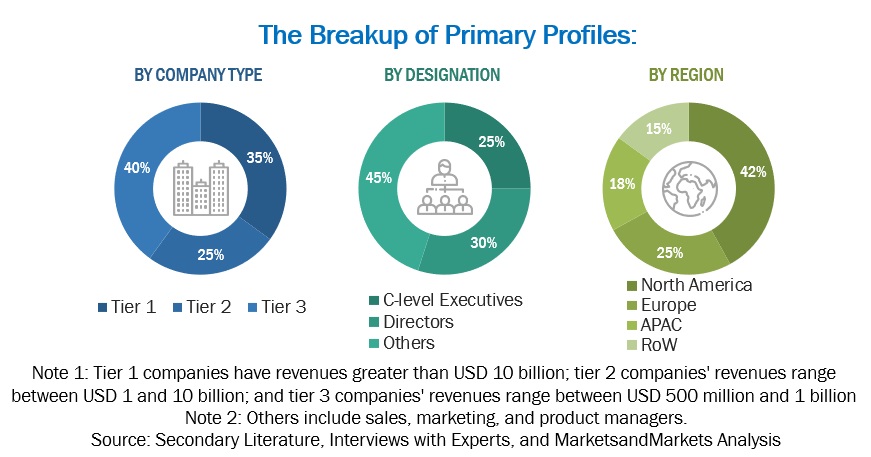

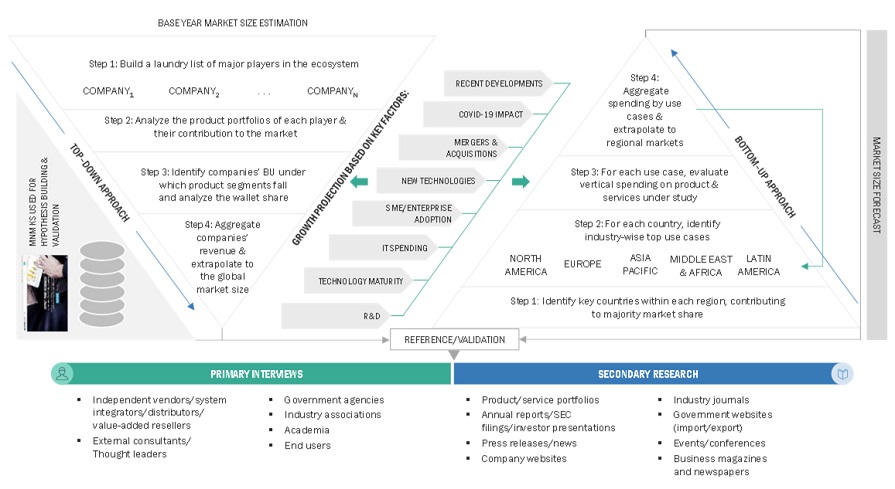

The study comprised four main activities to estimate the enterprise content management market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various enterprise content management market segments using the market breakup and data triangulation techniques.

Secondary Research

The size of companies offering enterprise content management markets and services was determined based on secondary data from paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on the ECM market was extracted from the respective sources. Secondary research was mainly used to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the enterprise content management market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing enterprise content management offerings; associated service providers; and is operating in the targeted countries. all possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis of the complete market engineering process was performed to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The enterprise content management market and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. The bottom-up method was used to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, the overall market size was utilized in the top-down approach to estimate the size of other individual markets.

Top Down and Bottom Up Approach of Enterprise Content Management Market.

To know about the assumptions considered for the study, Request for Free Sample Report

The research methodology used to estimate the market size included the following:

- Primary and secondary research was utilized to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which were calculated using secondary sources.

Data Triangulation

The market was divided into several segments and subsegments using the previously described market size estimation procedures once the overall market size was determined. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

MarketsandMarkets defines Enterprise Content Management (ECM) as a systematic approach to managing an organization's entire information lifecycle. It involves capturing, storing, managing, and delivering content and documents related to organizational processes. ECM aims to organize, categorize, and secure content, making it easily accessible to authorized users. It encompasses document management, web content management, records management, digital asset management, and workflow management. ECM improves an organization's collaboration, efficiency, and compliance by centralizing content management.

Key Stakeholders

- Training and consulting service providers

- Information Technology (IT) infrastructure providers

- ECM solutions providers

- ECM service providers

- Government organizations and standardization bodies

- Regional associations

- ECM vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the enterprise content management (ECM) market based on offering, business function, deployment mode, organization size, vertical, and region.

- To provide detailed information about the significant factors, such as drivers, opportunities, restraints, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size concerning five main regions — North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the market's key players and analyze their size and core competencies comprehensively.

- To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the enterprise content management market globally

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the enterprise content management market

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Content Management Market